I tend to bookmark all the interesting charts I find on Twitter and it’s time to sum up the findings from the last month or so . Many great minds are present on Fintwit, which makes Twitter one of the best content discovery platforms, allowing us to surround ourselves with smart people willing to share their knowledge and findings for free.

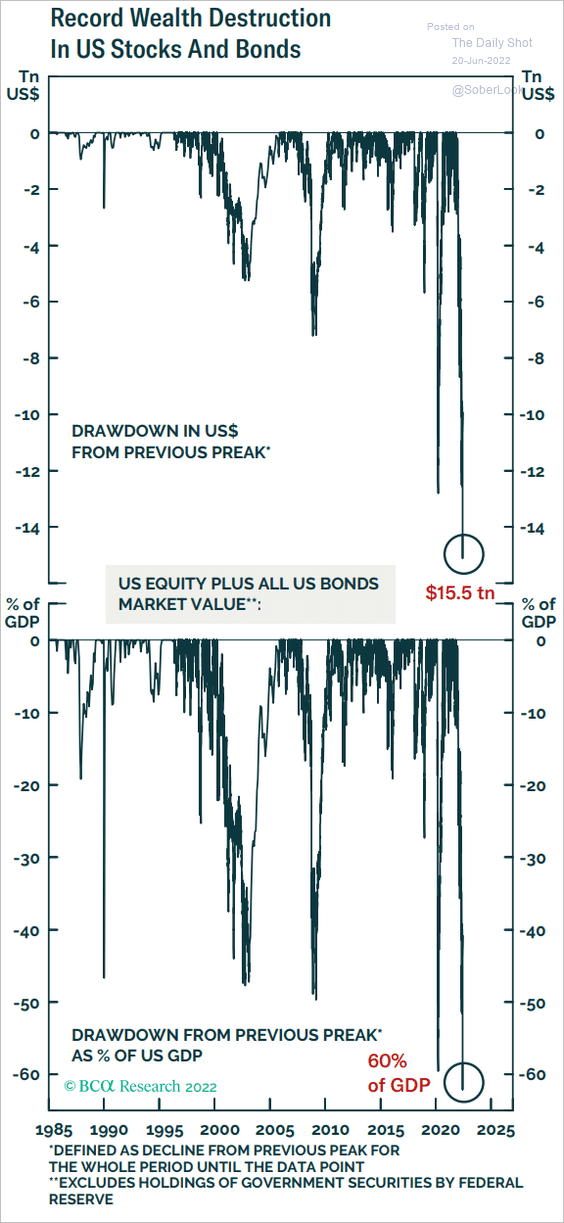

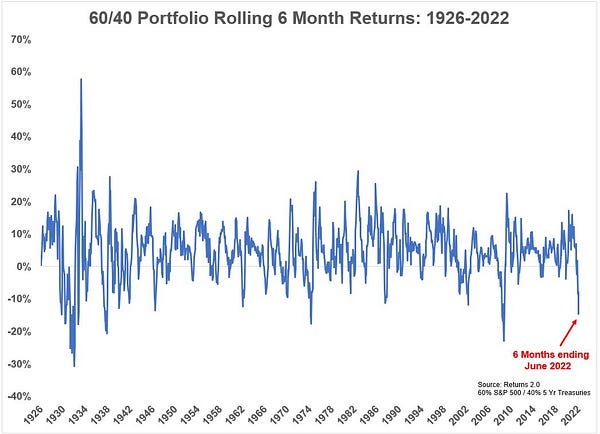

Wealth destruction and 60/40 portfolio

We have witnessed one of the biggest wealth drawdowns in the last 40 years. The pendulum went from one extreme to the other.

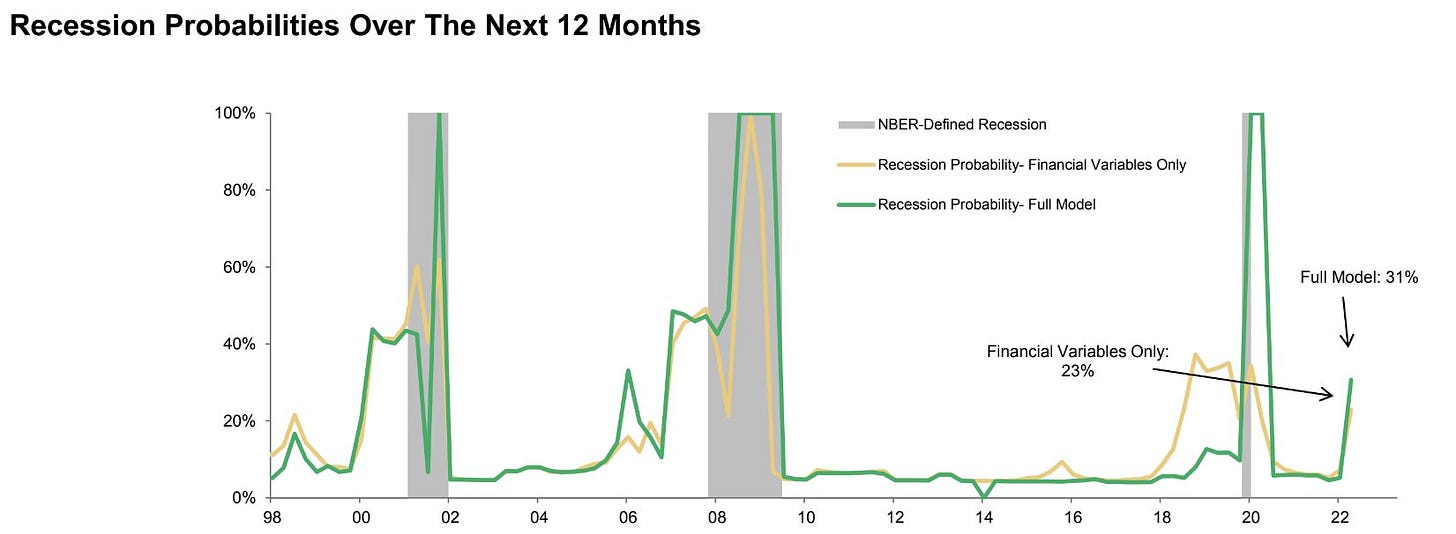

Recession

Recession probabilities are on the rise, and it has been all but confirmed in USA, with the latest GDPNow from Atlanta FED. How long and how deep is it going to be, if we get one?

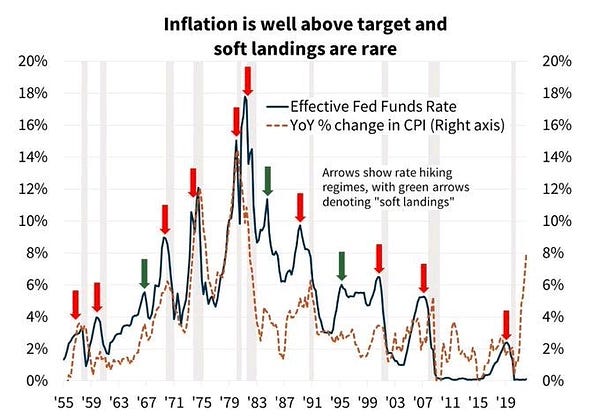

As Druckenmiller said recently at Sohn conference:

Once inflation gets above 5%, it’s never been tamed without a recession

Hard landing is more likely than soft landing:

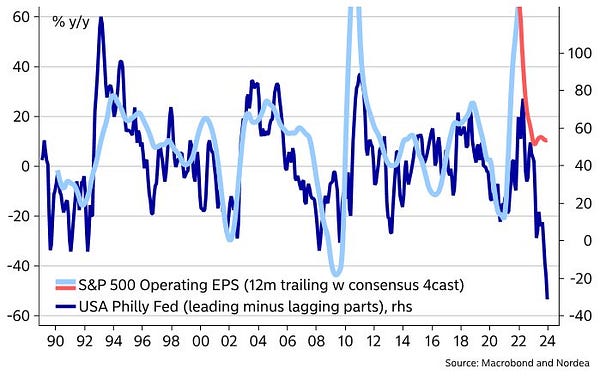

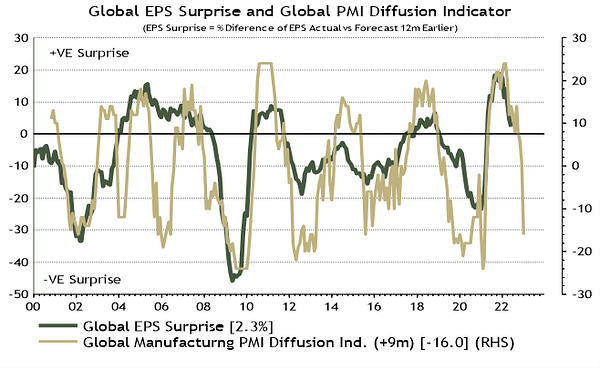

With forward estimates holding as high for so long…

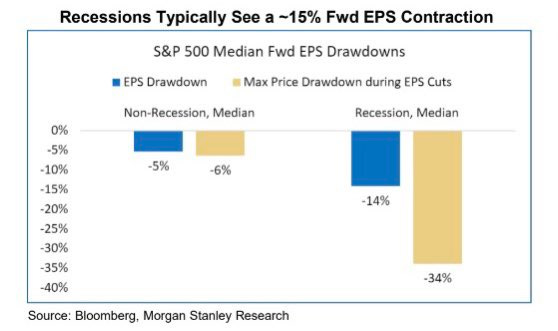

...one has to be aware of the magnitude they could miss in case we get a proper recession.

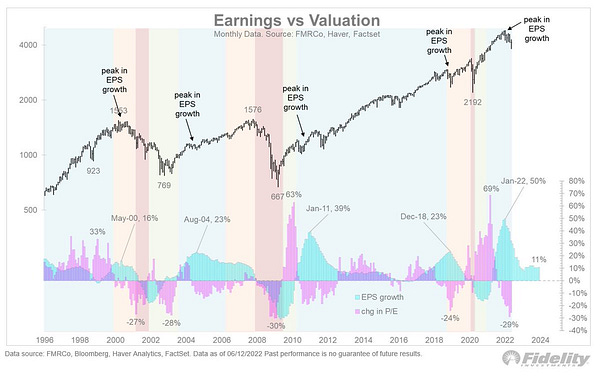

Earnings expectations & current valuations

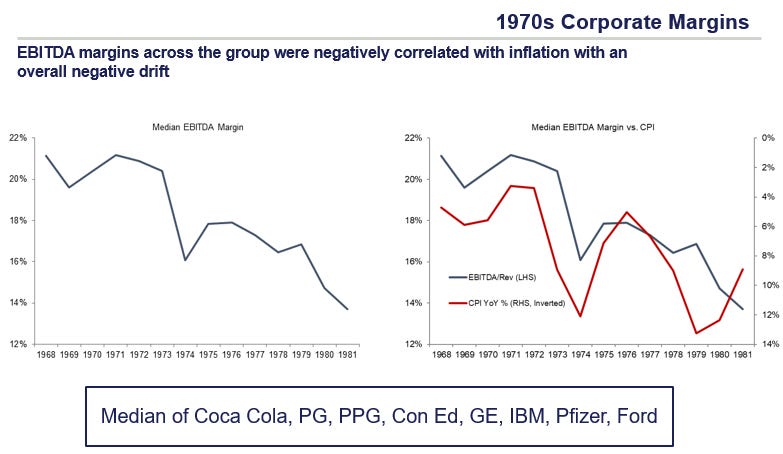

With margins as high as they are and with the pressure of higher wages and high inflation, it’s hard to believe we won’t see an EPS contraction.

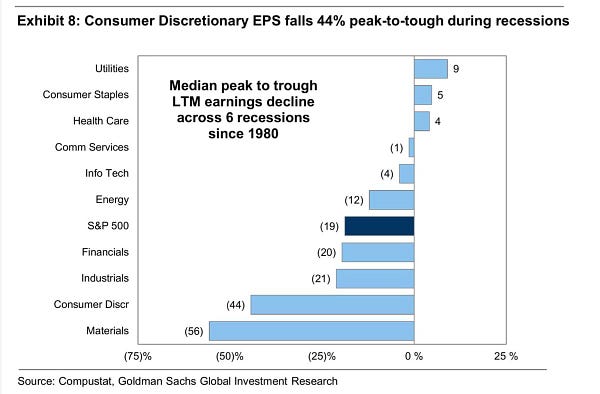

We can assume history rhymes, so it’s good to know which sectors may get hit the hardest. Some of the sectors are already pressured by COVID related supply chain bottlenecks and some kind of relief is possible

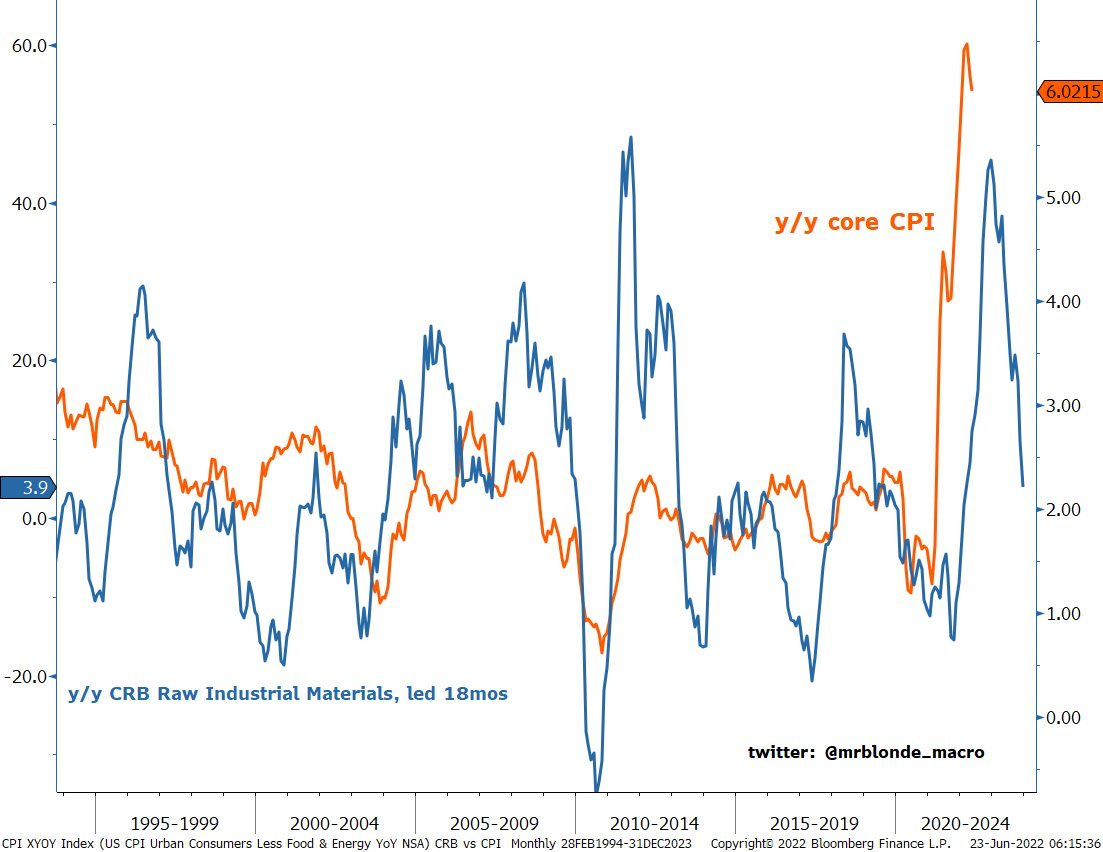

Hopefully, with currently falling commodity prices, we’ll slowly forget about 1970s analogies.

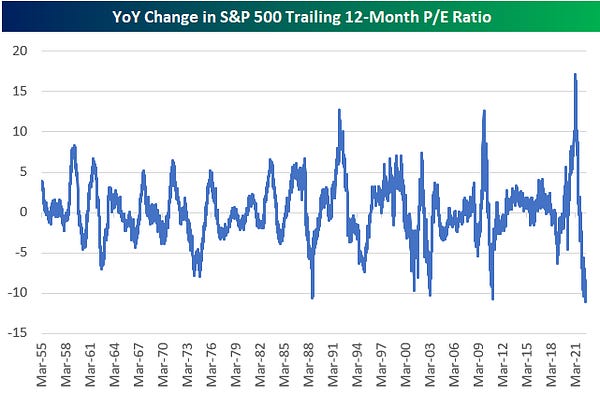

Pendulum-like swings again with valuation measures YoY change:

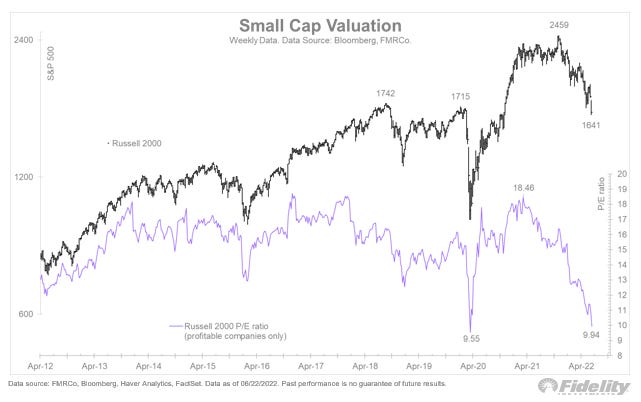

The biggest hit has been taken by small-cap stocks, which are again in highly attractive territory:

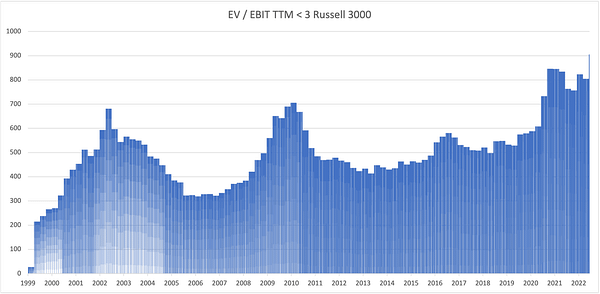

…for instance, a record high number of stocks trading under 3x EV/EBIT in Russell 3000. Buy IWM 0.00%↑ and go away?

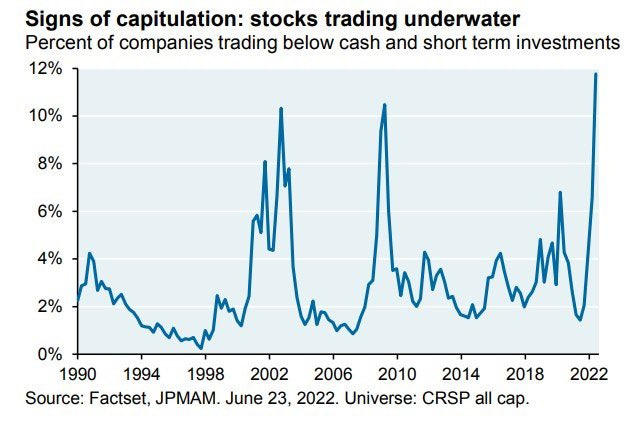

We’re also seeing a record percentage of companies trading below cash and short term investments

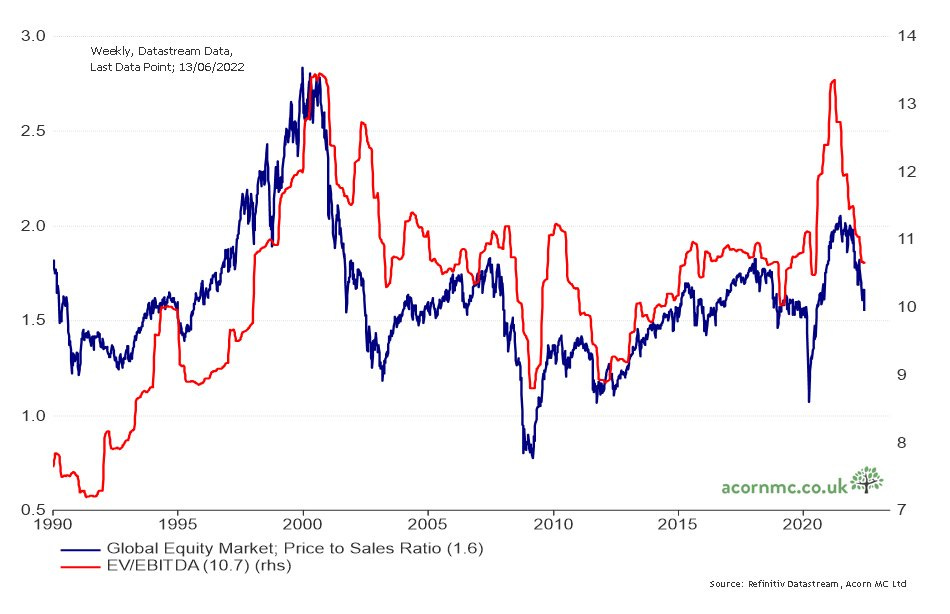

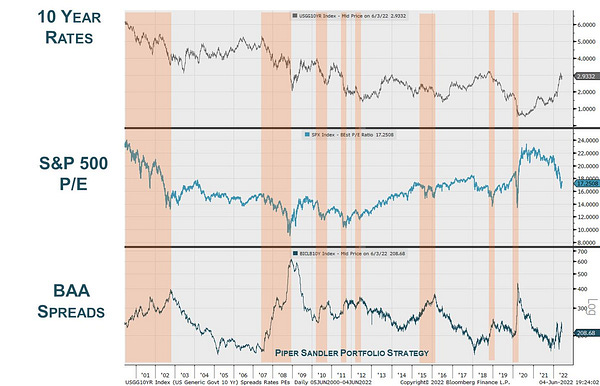

Valuations in general are not so ‘out of mind’ anymore

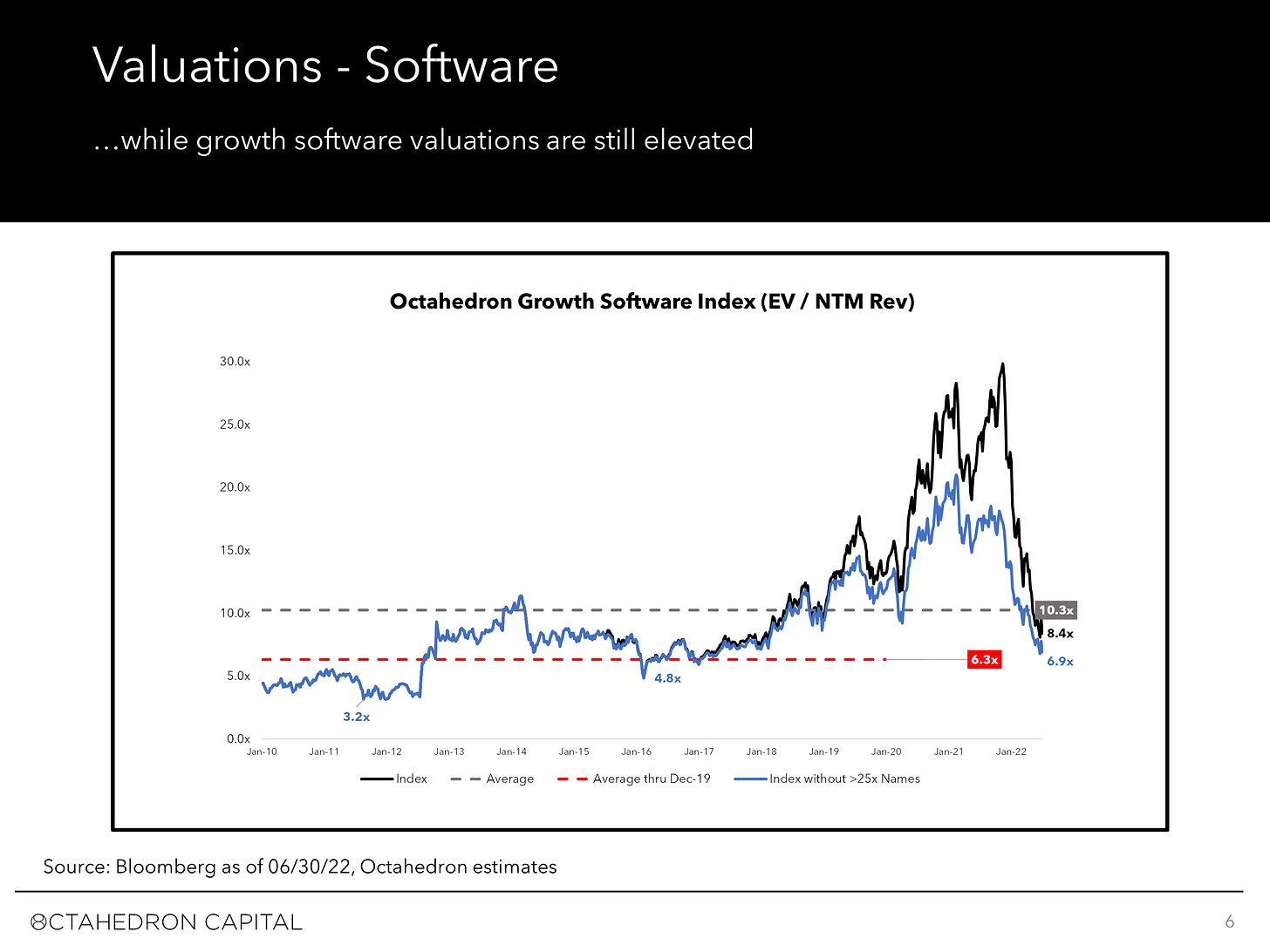

Even in high growth tech names, valuations are back to this secular bull’s range

Of course, valuations can always go lower, even more so if we see earnings contraction and multiples wants to catch up with the downward revisions.

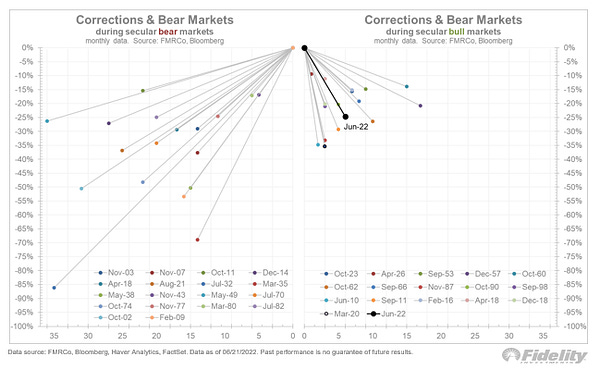

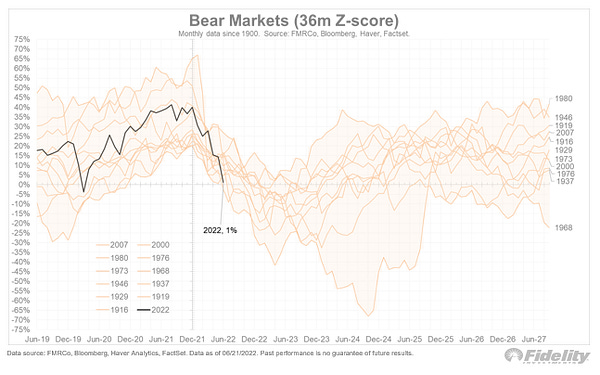

As meester Jurrien Timmer says (definitely follow his work), it is important to determine if we’re still in a secular bull or a newly started secular bear market:

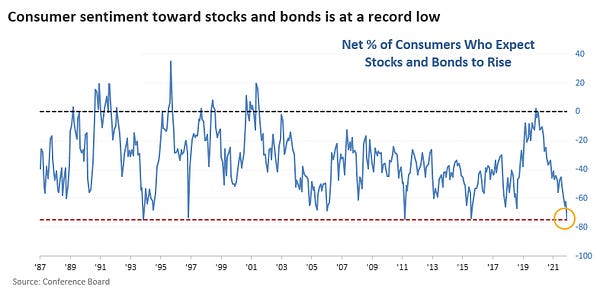

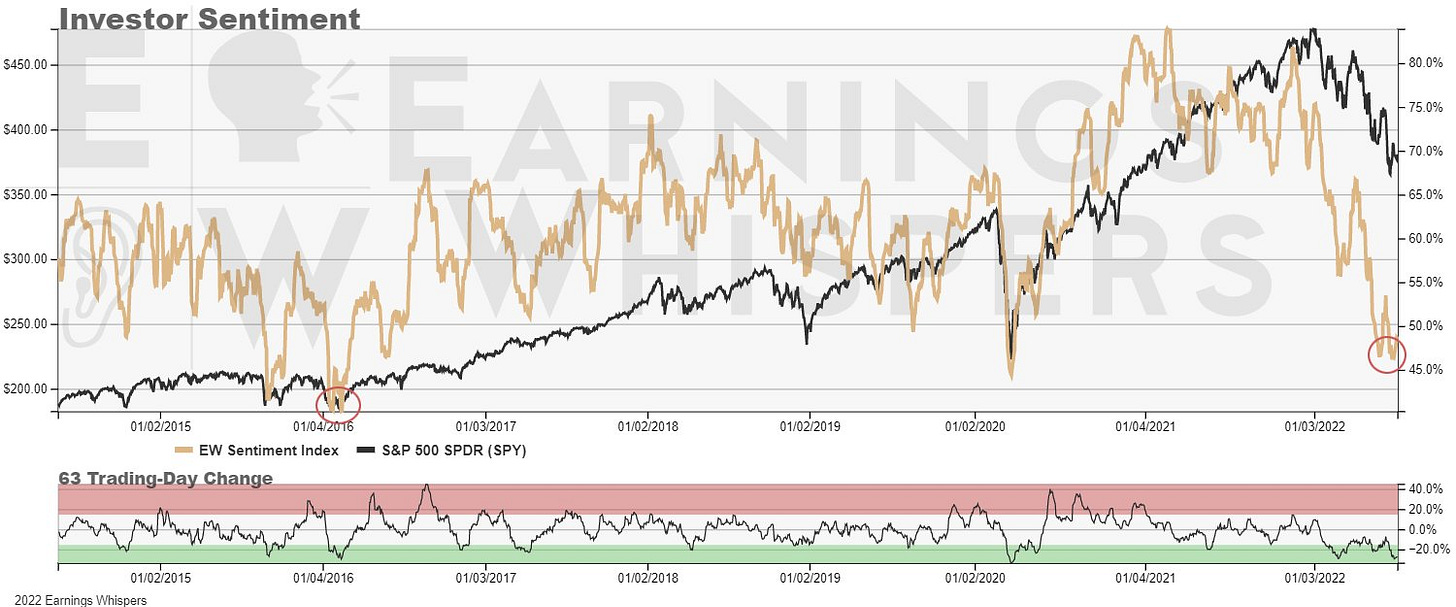

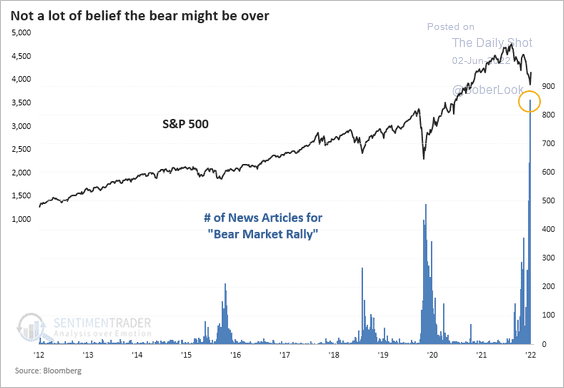

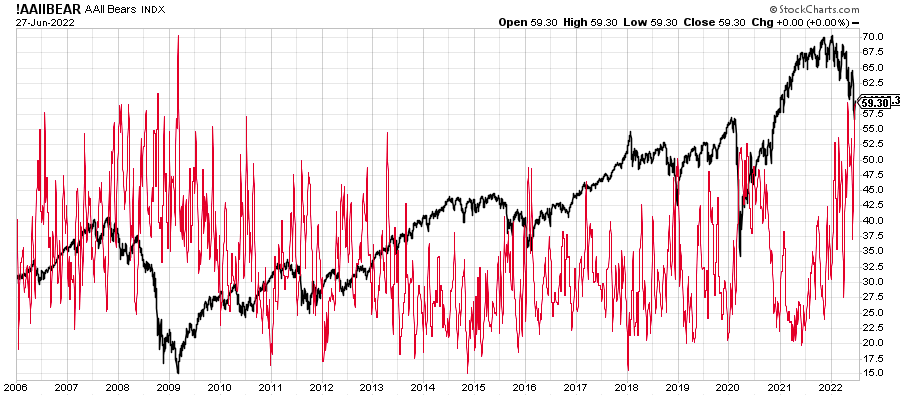

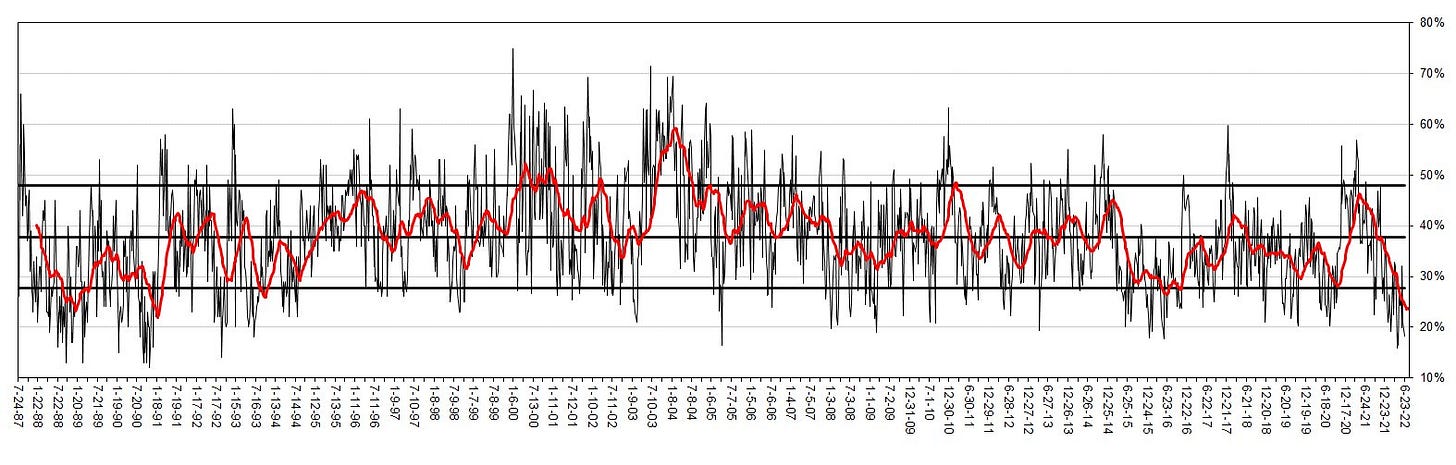

Investor sentiment

In short, sentiment is so low that it is screaming ‘a buy’:

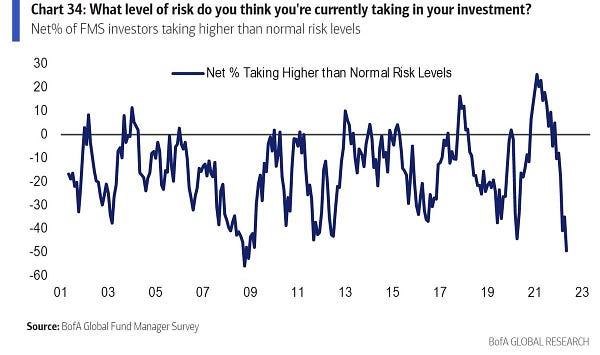

Even the global fund managers are scared

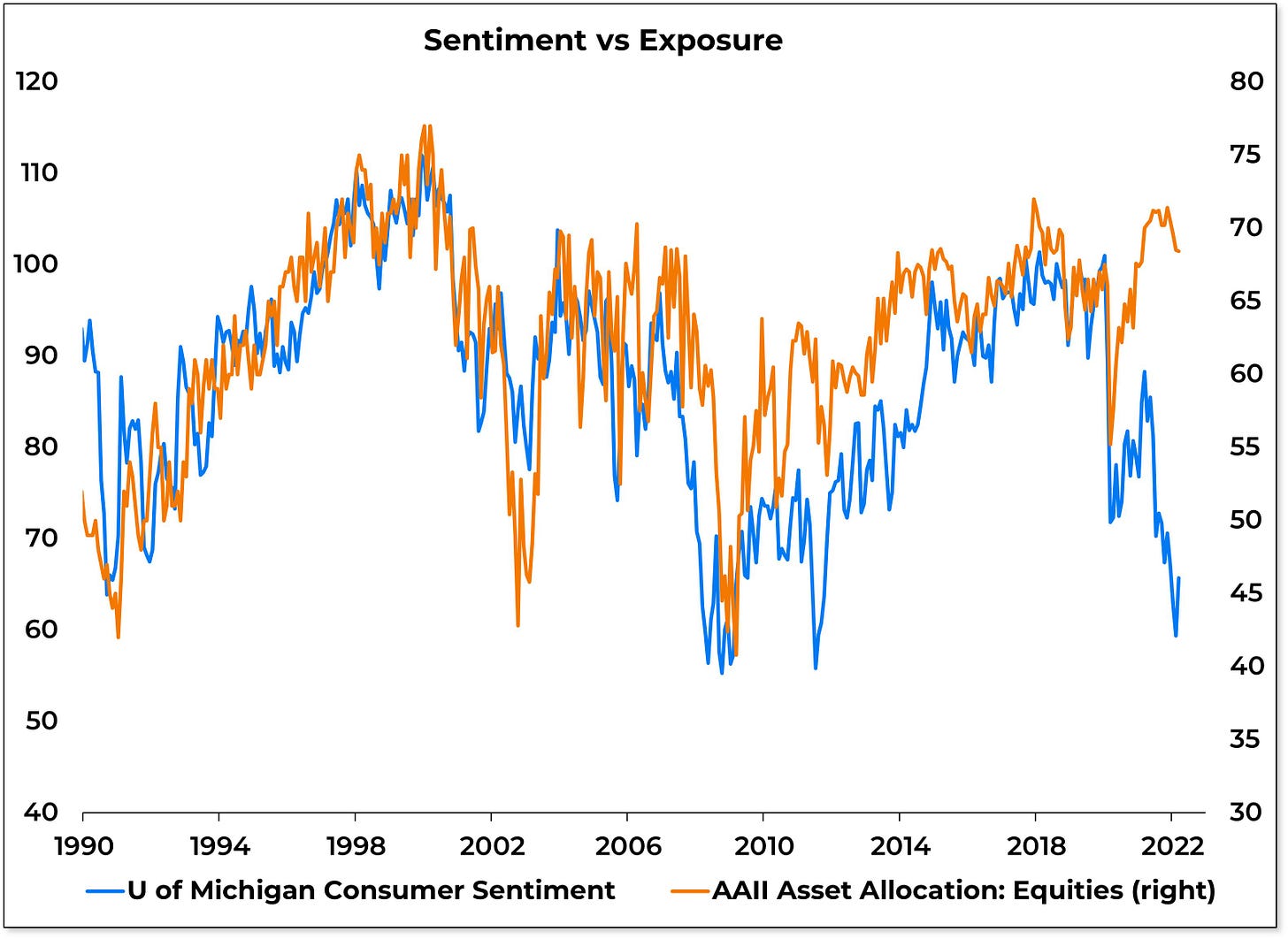

But, the truth is that positioning is a lot more bullish than what emotions say. Which one to trust?

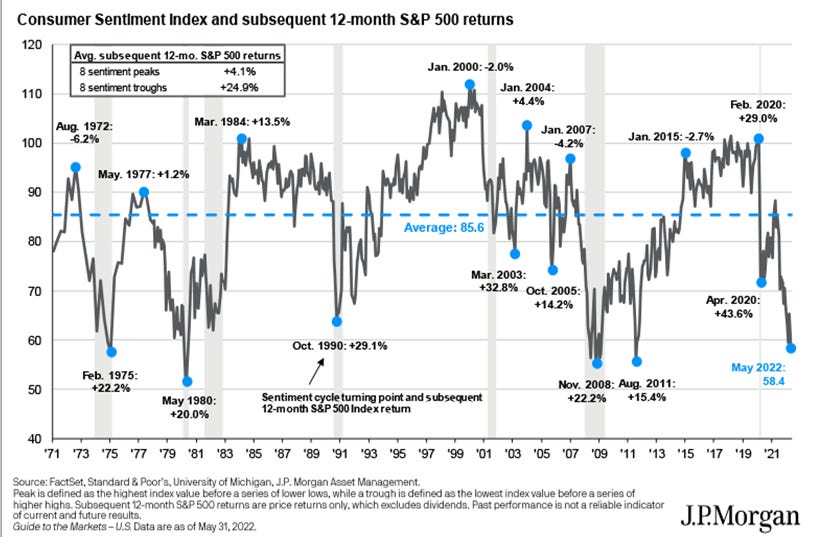

According to JP Morgan, historically when UMich Consumer sentiment is extremely low, contrarian mindset is given an opportunity for some great returns in the next 12 months:

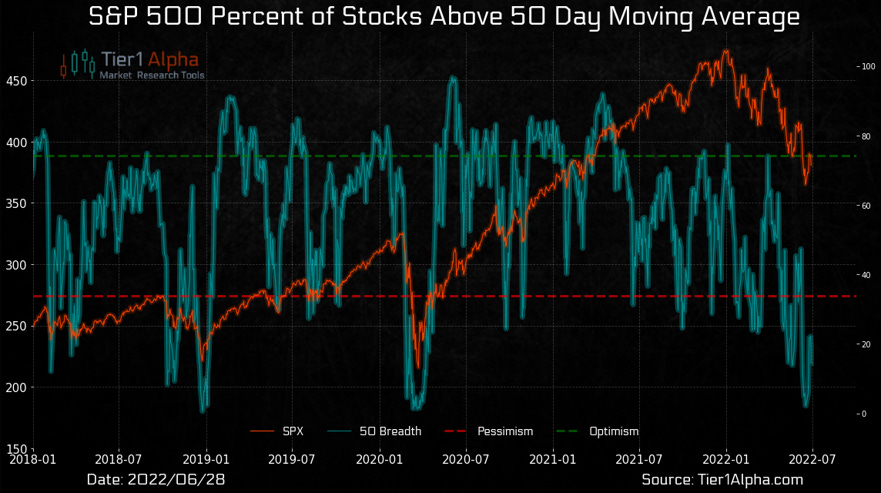

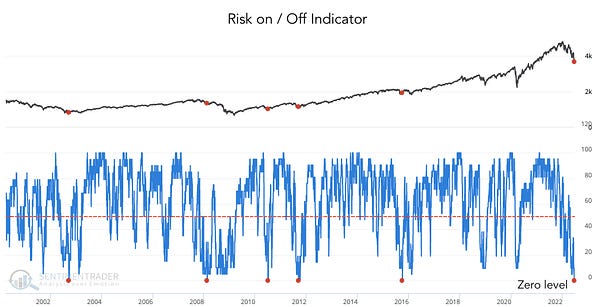

S&P 500/Nasdaq signals

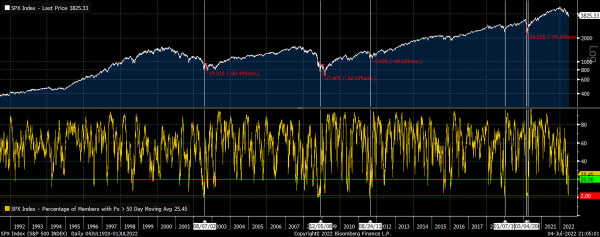

When we get a sharp reversal (2% -> 20%) of number of stocks over their 50-day moving average, we’re near the bottom.

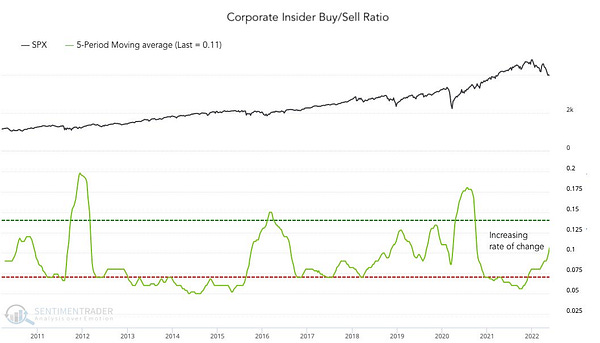

We’re even seeing some corporate insider buying picking up. If they don’t know what they’re buying…

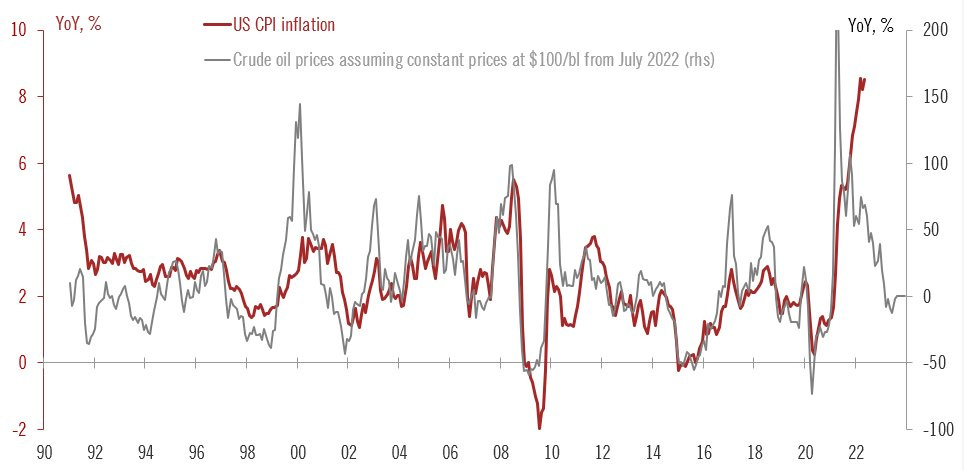

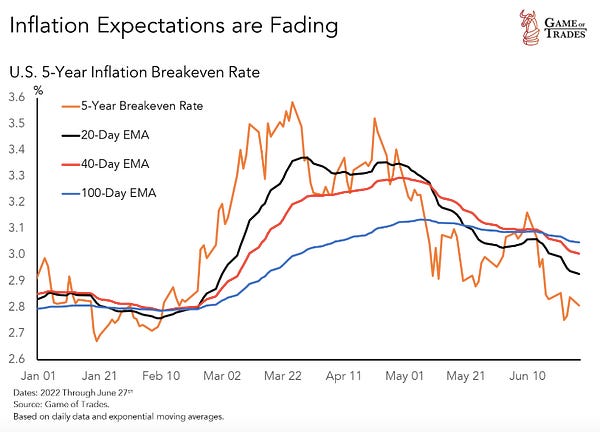

Inflation peaking?

If so…

What if central banks are right and inflation has just peaked, as they were hoping for?

More and more signs of inflation peaking and easing down…

That would be all from me!

Best wishes,

Marko

Disclaimer