Some of my 'unfocused' shares & thoughts III

...sharing my findings from the last month or so, primarily to focus my views on the current market situation. Panta rhei...

Recession & Inflation

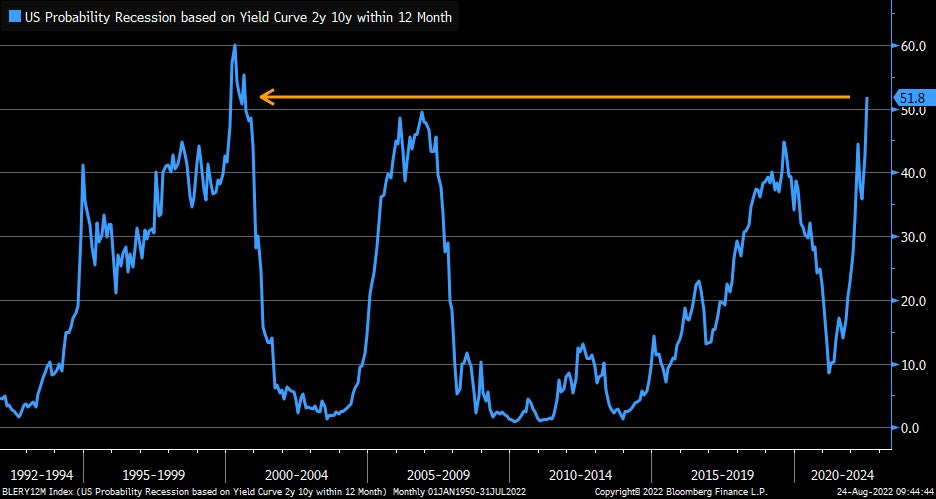

Recession probability has shot up to the levels last seen in 2000 and 2007

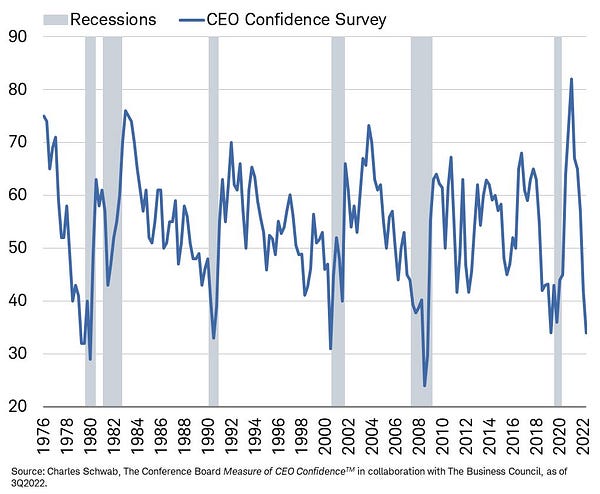

CEO confidence Survey confirms such an environment

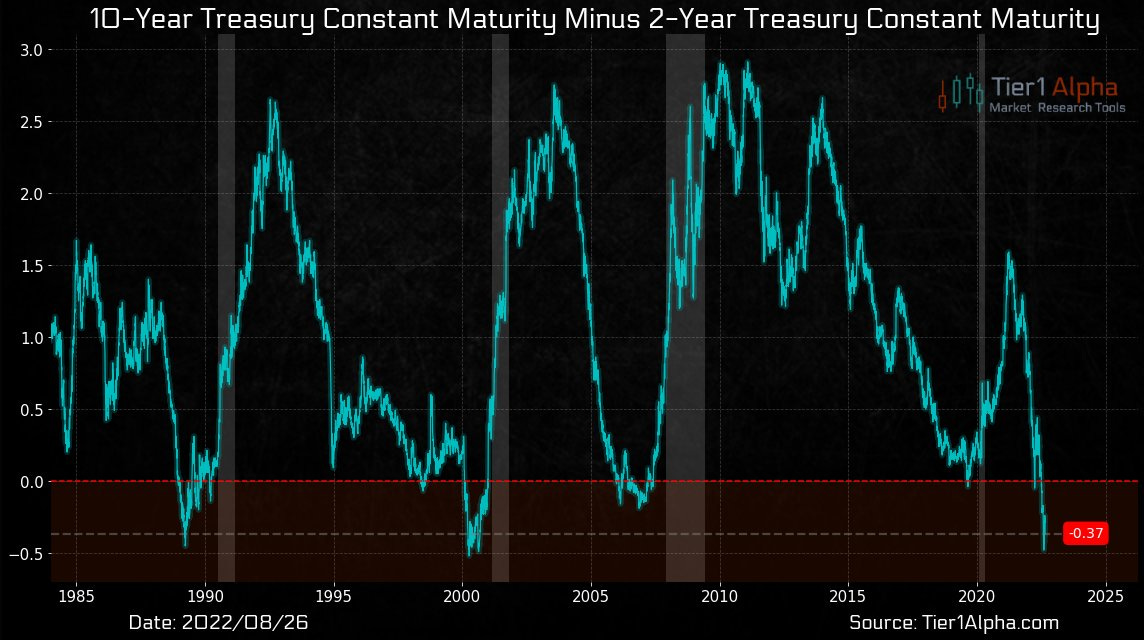

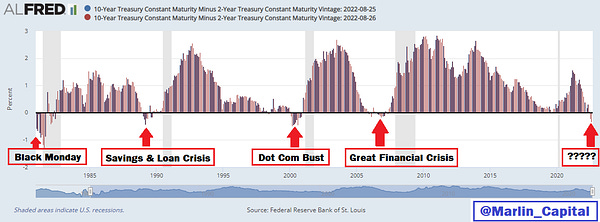

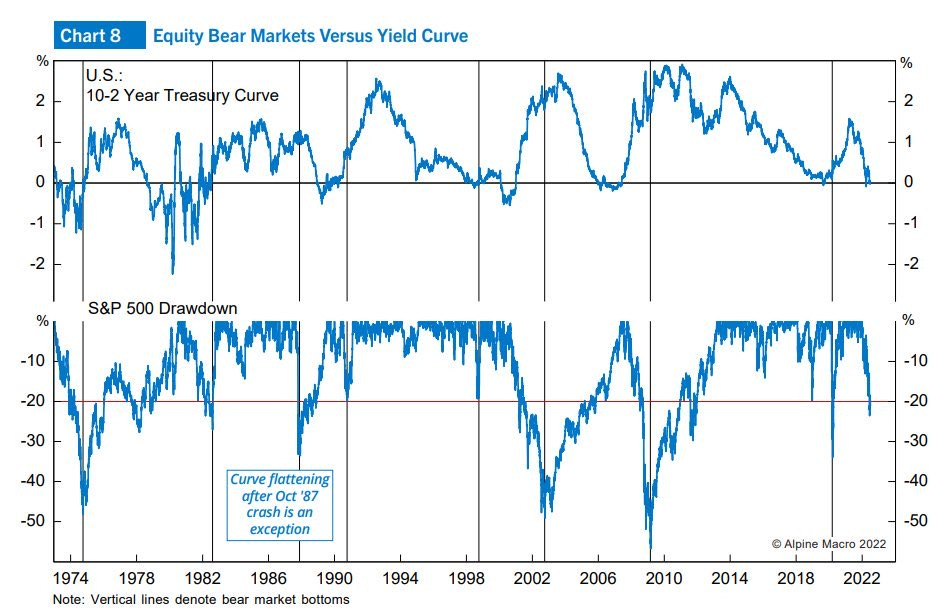

2/10 yield inversion tends to be correct preceding recessionary times, at least in the last 30 years. Such an event usually has its catalyst to be felt worldwide - it may be Europe, EM, real estate bust in China, who knows.

Being a correct predictor in the past, doesn’t confirm the recession inevitability nor its amplitude. I tend to believe that we are going to experience one this year, but what do I know

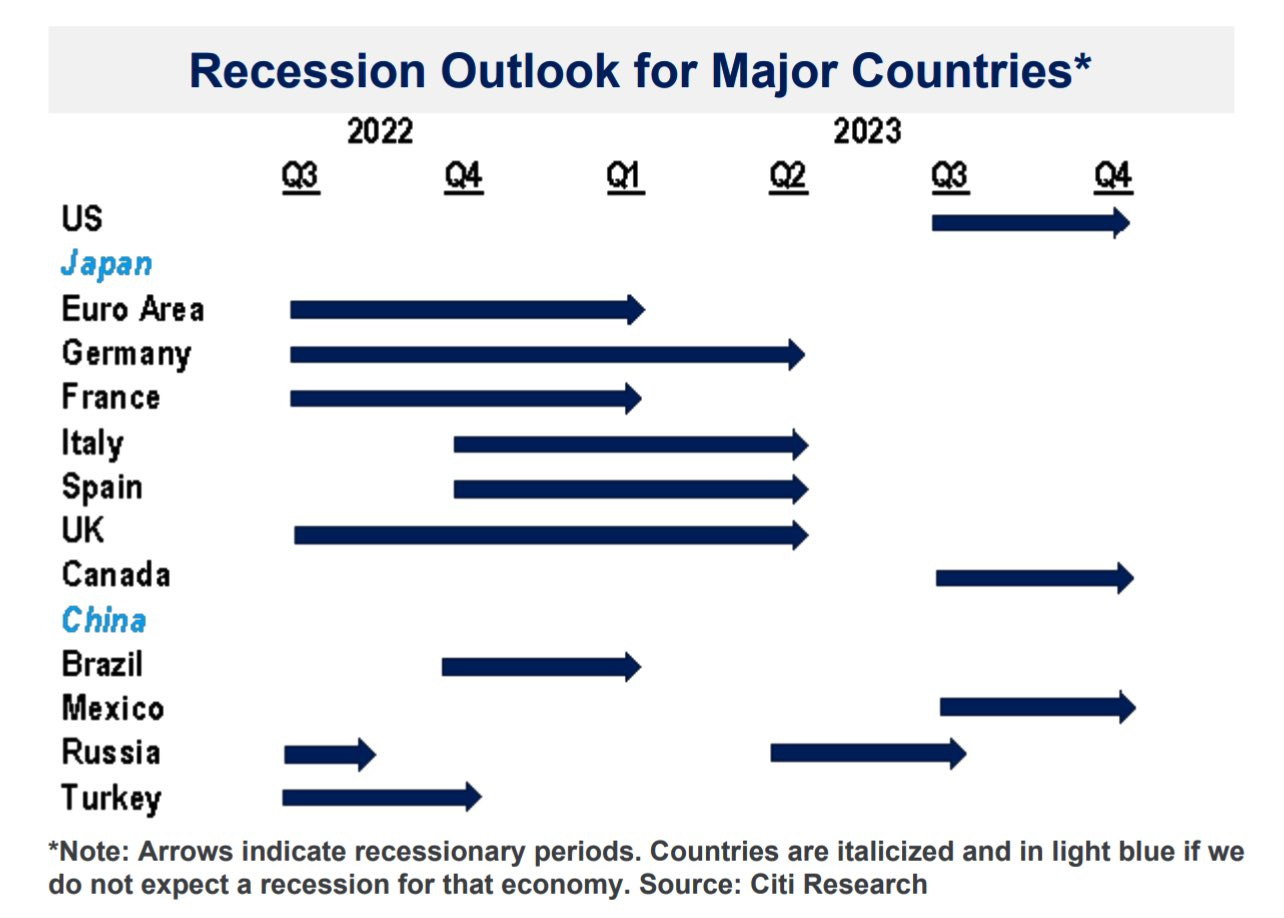

Here is how Citi sees it

Markets, and we have yet to confirm if we’re in a cyclical or a secular bear market, usually react by falling some time after curve inversion and tend to react upward after the curve steepens again. Definitely no rule of thumb here.

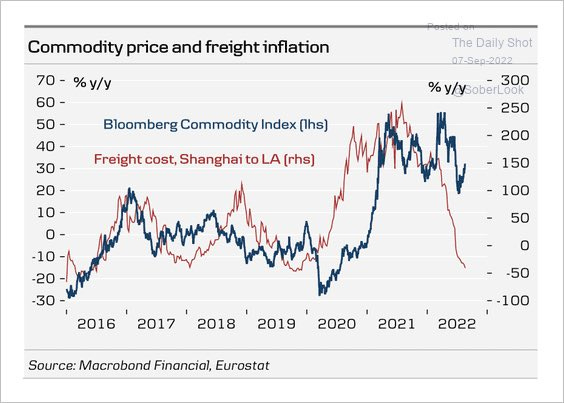

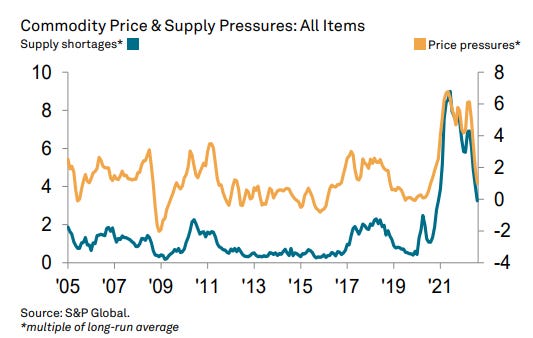

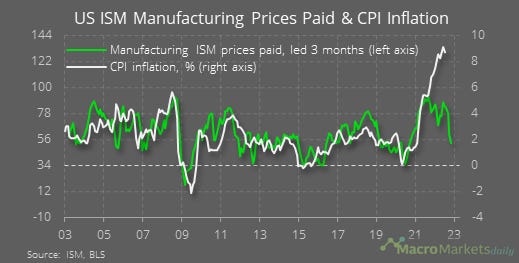

In the meantime, we’re getting more and more signs of inflation fading (not so much in Europe), hopefully for good

Even some forward looking indicators are confirming the disinflation and I wouldn’t be surprised if I we are going to experience some deflationary periods during 2023

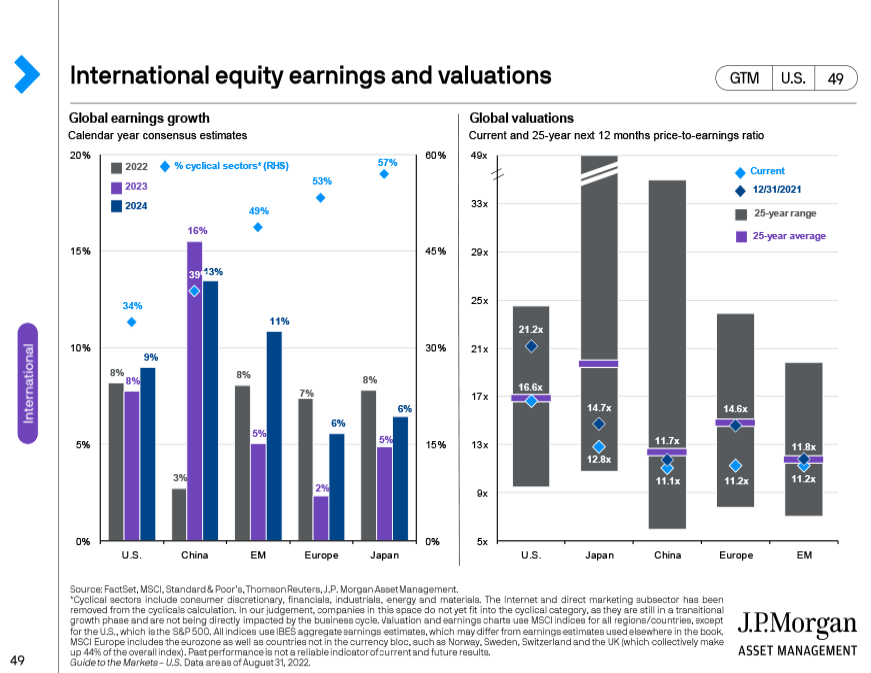

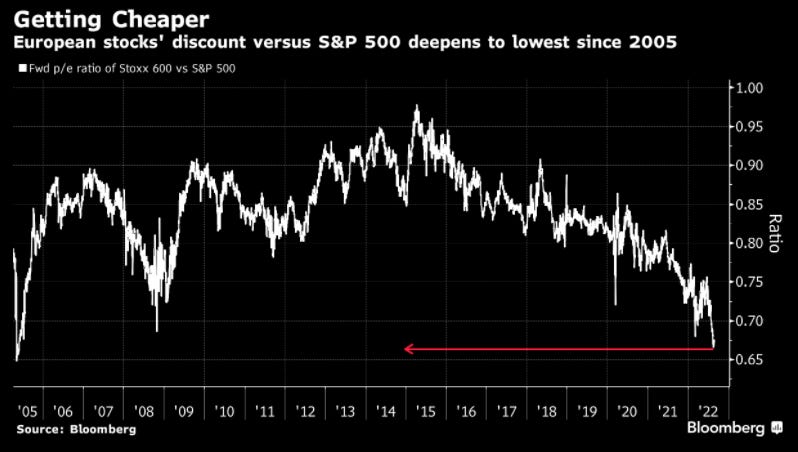

Valuations - Europe

I don’t think Europe is going to shit and so I find these valuations attractive

It’s valuation is historically attractive vs S&P500 but also vs its own 25-year average

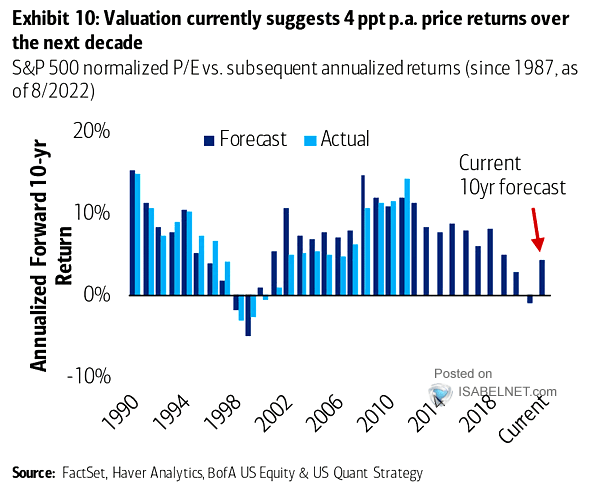

Valuations - USA

Based on BofA model, they are projecting 4% return in the coming 10 years time

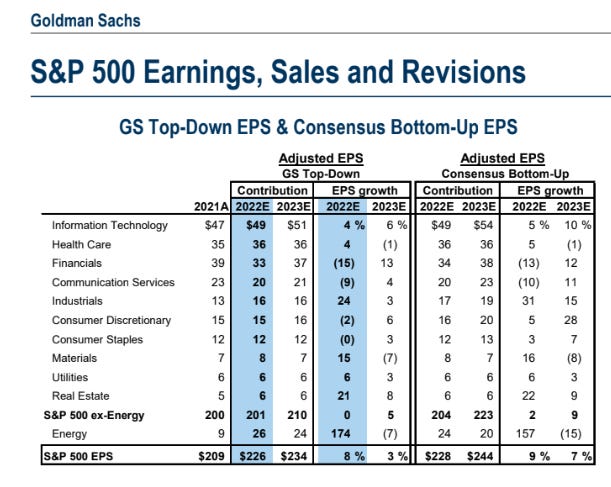

S&P500 EPS growth is in the hands of Energy sector

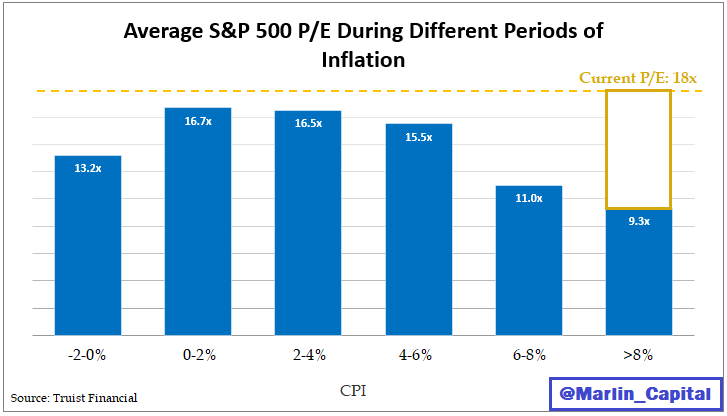

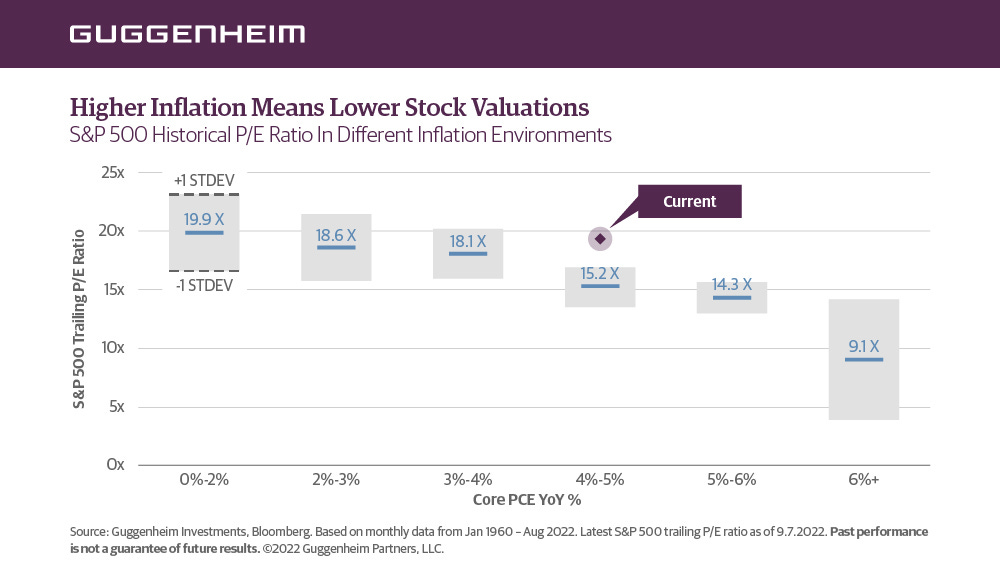

h/t @MikeZaccardi Based on current inflation numbers, market has some downward catch-up left. For instance, if an optimistic forward EPS of $234-238 is true, S&P500 at 2300 wouldn’t be a news, but markets are always discounting the future and if inflation is not sticky (which I believe so) I wouldn’t expect the market to get to 9-11x P/E levels.

Combination of lower expected EPS and still high inflation would be lethal for many market participants, myself included

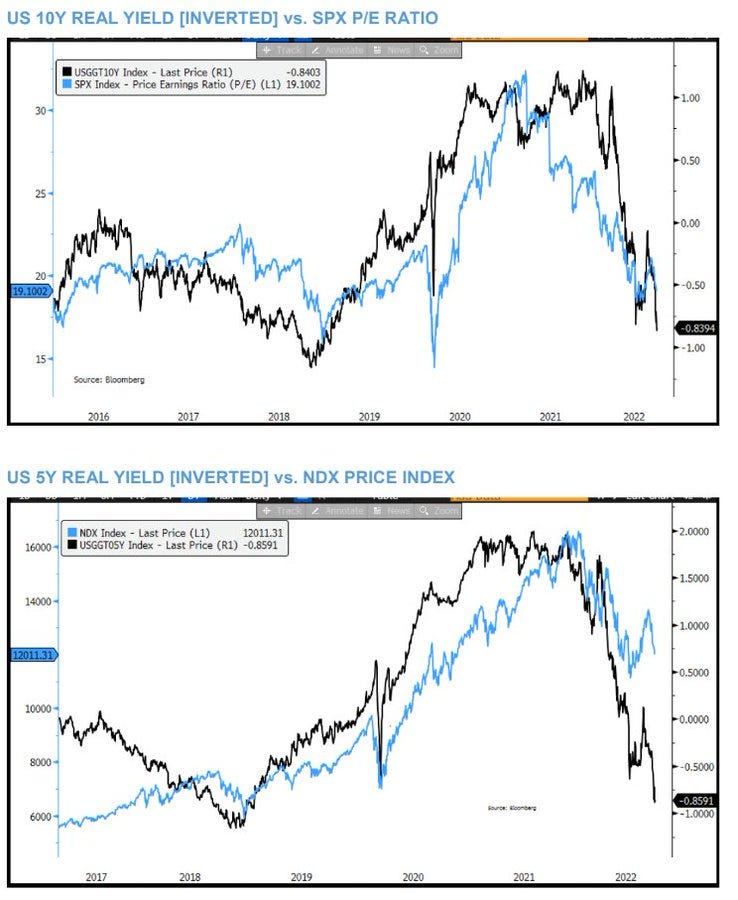

While in the shorter timeframes, market valuations are sensitive to interest rates…

…there is no proof of correlation, based on 150 years of data

If we are truly in a secular bear market, then we’re in for more pain in the coming time. In such a case, a further 20-30% market decline wouldn’t be a surprise. That’s why we shouldn’t marry any opinion of where the market is going…

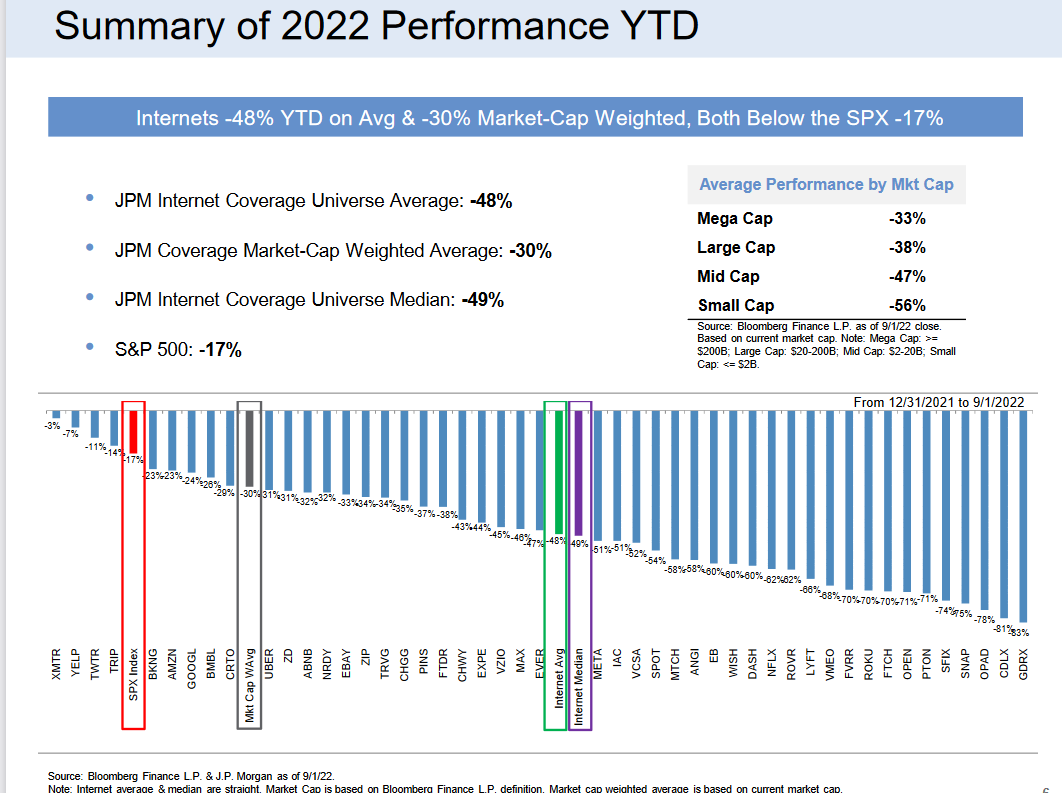

Many popular internet stocks have brought a lot of pain this year, as can be seen in the following chart

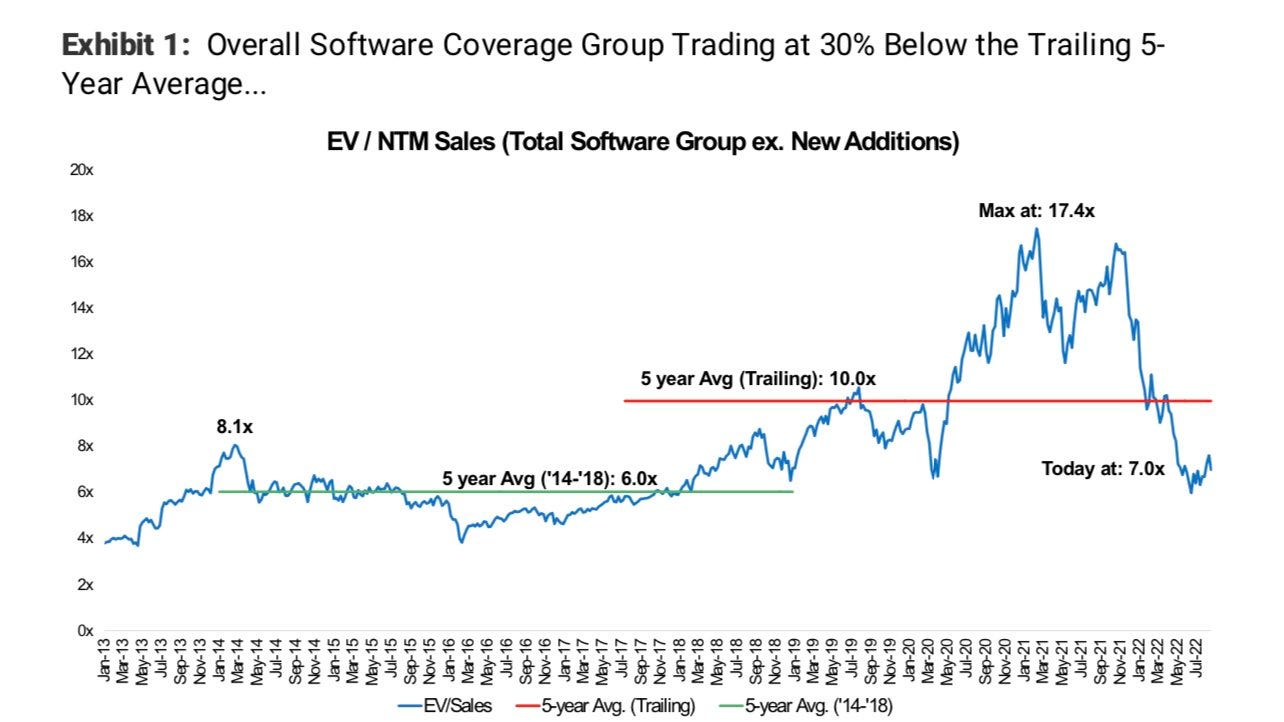

But investing in group of growth stocks now is more rational than to do it just a year ago. What a difference a year makes…

Investor Sentiment & Other signals

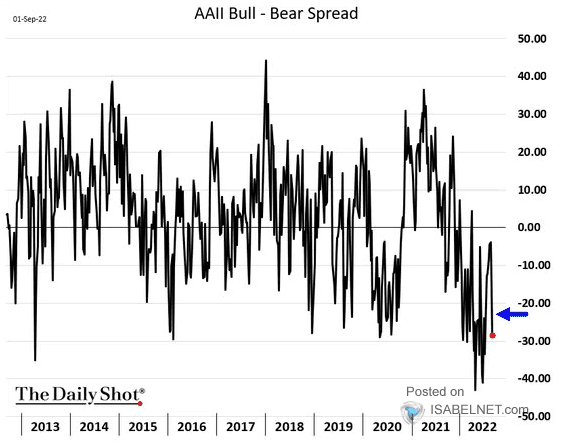

AAII US investor sentiment is extra bearish…an opportunity for contrarians?

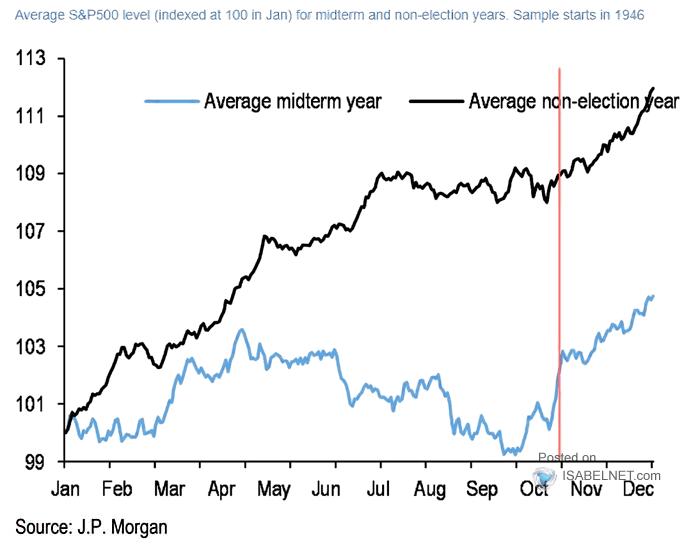

Are we in for a strong rest of the year return, based on average post-midterm returns?

Reminders for the end

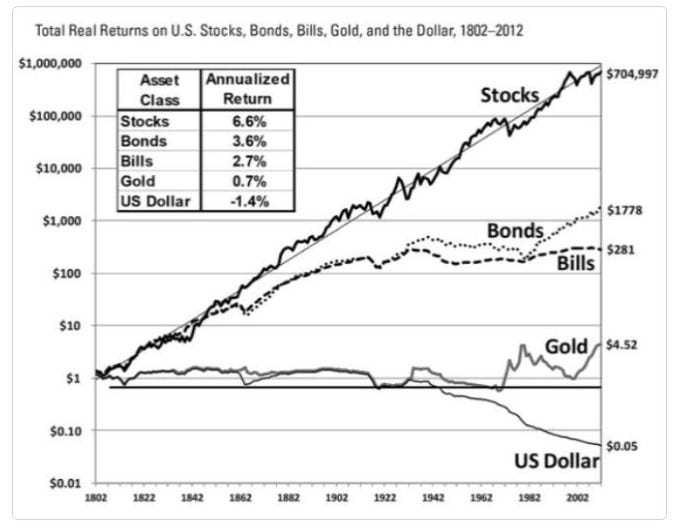

Often shared chart, but easily forgotten - investing in businesses in the public markets has the strongest returns on a long enough timeline

And as much as we would love to be able to time the market, the opportunity cost of missing the best days is too high

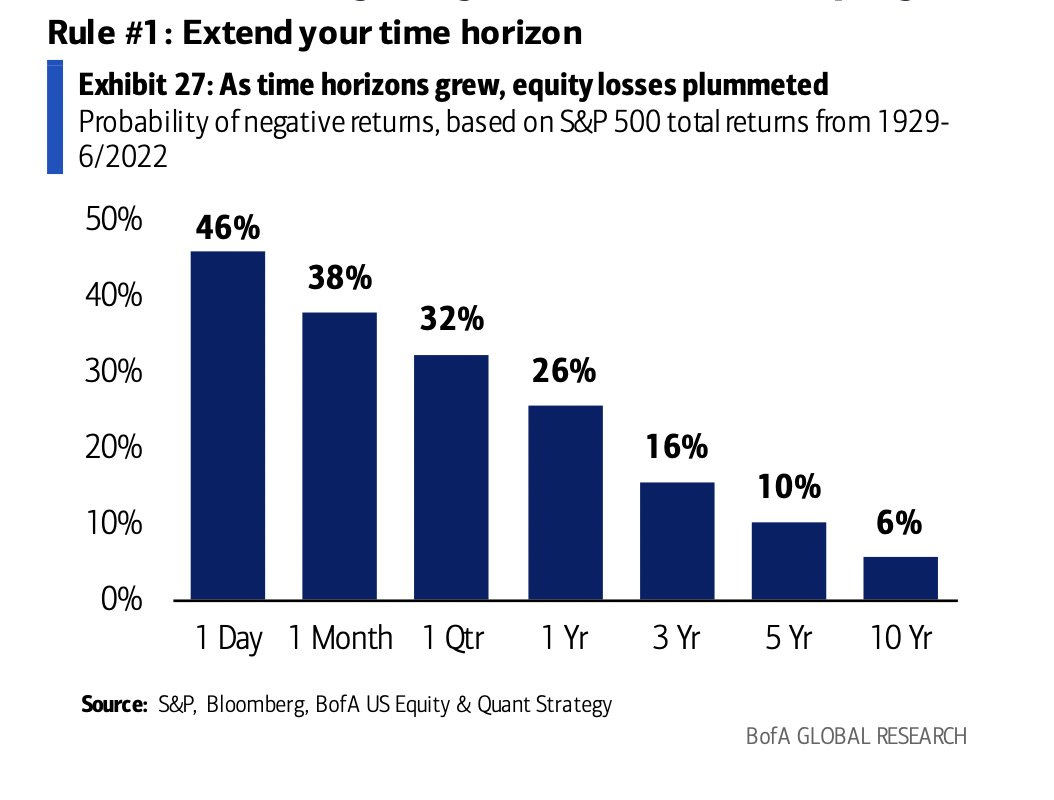

So, longer the time horizon we set ourselves, easier it will be to endure the losses

h/t @juleshyman

That’s it for today!

Best wishes,

Marko