Circumstances under which we are investing in the last 2 years and especially this year, have probably been the most difficult ones I have experienced.

We are witnessing a mix of a commodity price shock, FED tightening, yield curve inversion and all of this during the time of war, which added fuel (no pun intended) to the commodity shock. What else can go wrong?

Or more importantly, what can go right from now on?

…see how quickly we’ve forgot about COVID?

What if war ends soon, inflation scare disappears with the end of the year and recovery from a probable recession proves to be fast…

I’d like to share some of the interesting charts and thoughts which I find relevant for today’s conditions 👇

The 2/10 yield curve inversion has preceded almost every recession since 1955 (only one false signal).

As Ed Yardeni recently said: “History shows that the only way to stop inflation is to cause a recession.”

But, as Ryan Detrick mentions, the last four times it inverted

The last four times the 2/10 yield curve inverted: S&P 500 up avg of 28.8% before peak. Ultimate peak was 17.1 months later. Recession started 21.0 months later. Yes, it is a warning, but it isn't so simple.

The last four times the 2/10 yield curve inverted: S&P 500 up avg of 28.8% before peak. Ultimate peak was 17.1 months later. Recession started 21.0 months later. Yes, it is a warning, but it isn't so simple.What may be a difference in reaction, could be a speed of tightening

Sooner the 2/10 inversion happens during hiking cycle, sooner would recession follow – inversion in 2022 happened in record time. But why did the market rally recently - or was it just a bear market rally?

We have a huge divergence between market reactions to yield inversion pre 1980s and post 1980s.

Maybe the main difference is in inflation trending lower post 1980s?

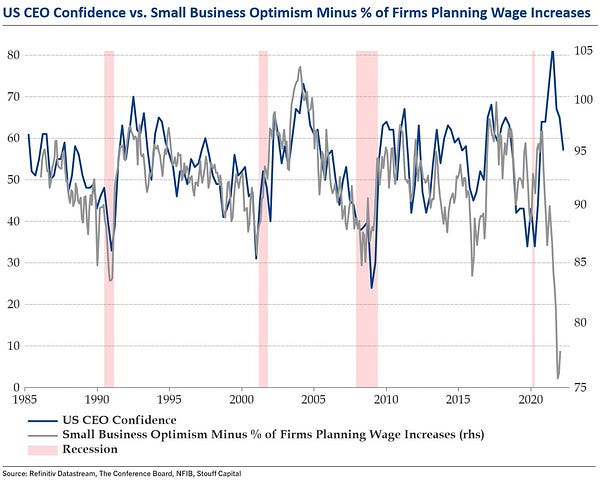

Combination of expected wage growth, tight job market and inflation could lead to a lowering of operating margins and consequently to a falling CEO confidence index – recession imminent? …and how to prepare our portfolios?

Consumers may have a saying in this

During 1970s stagflation, here are the list of winners

But, as Andreas Steno says: “BUT! There are two mega-differences to the 1970s. First, we are no longer an industrial economy with a booming labor force organized in super strong unions demanding huge real wage increases despite a strong cost pressure on companies. Second, the current gusts from 70s are faced with an exponential growth in technology, which means that companies need substantially less labor to produce the same amount of profit as fifty years ago. This is called productivity and companies probably won’t get better incentives than right now to invest in increasing productivity given the marked rise in input prices from both labor and materials. We will likely see the effects of those “forced” productivity gains in years to come. If this is enough for an already expensive tech sector to weather the storm through Q2 is a bit more debatable, but I remain calm about my structural exposure towards this sector and it is also noteworthy how for example Intel performed through the stagflationary 70s despite being a tech company.“

What if…

Bank of America argues that we might be in the middle of a secular bull which may continue growing until the end of the decade, probably meaning S&P 500 at ~8000 points.

Midterm election years tend to have a rally after the elections

😴 till then?

I know that I have no idea where are the markets going but an open mind is a must in these conditions. Maybe we should get back to Buffett and try not to lose money?

"Bulls make money, bears make money, pigs get slaughtered"

Best wishes,

Marko

Disclaimer